Why should prime real estate, fine art, or infrastructure projects remain out of reach for most investors? Not to mention, today’s financial system is plagued by illiquidity, high entry barriers, and opaque markets—locking out capital and stifling opportunities. What if there was a way to break these chains? The solution to these age-old financial barriers has finally arrived—tokenization of real-world assets.

Tokenization of real-world assets is a process where physical or tangible assets are converted into digital tokens that represent ownership or a claim on the underlying asset. These tokens are typically created and stored on a blockchain, a decentralized and secure ledger technology.

Tokenization in Practice

Tokenization is creating a huge impact in a plethora of industries— democratizing access, unlocking trillions in trapped liquidity, and rewriting the rules of ownership.. Let’s have a look at various sectors which have benefited from tokenization:

Real Estate

Let’s begin with the example of real estate which is the second largest asset class after debt instruments. Suppose you own a building worth $100,000. Your $100,000 building earns peanuts in rent while sitting on a goldmine of untapped value. Tokenization changes the game: it slices your property into digital shares (tokens) that trade like stocks, appreciate in real time, and never sleep. The best part? You keep the keys—the tokens are just the financial supercharger your asset deserved all along.

Unlike physical real estate that demands all-or-nothing deals, these tokens enable granular ownership—buy or sell any fraction instantly. Their value mirrors the building’s appreciation automatically, creating a seamless bridge between tangible and digital wealth. And here’s the game-changer: every transaction, ownership record, and valuation update lives on an immutable public ledger, eliminating opacity and bringing unprecedented transparency.

Supply Chain Management

Supply chain businesses today grapple with crippling inefficiencies: billions in working capital remain locked in unsold inventory and unpaid invoices, while manual processes lead to payment delays that strain supplier relationships. Counterfeit goods and paperwork fraud lead to huge annual losses, and the lack of real-time asset visibility forces companies to maintain costly buffer stock. Traditional financing options come with exorbitant interest rates, often requiring physical collateral that takes assets out of circulation.

Tokenization shatters these supply chain constraints by converting stagnant inventory and invoices into liquid digital assets that work 24/7. By minting tradeable tokens backed by physical goods, businesses unlock instant financing without selling stock, thus solving the issue of cash paralysis. Moreover, these digital tokens provide an unforgeable chain of custody, stopping counterfeiters in their tracks while giving customers proof of ethical sourcing.

Private Equity and Venture Capital

Similarly, systemic issues within the private equity and venture capital asset class create significant challenges. Illiquidity stemming from 8-10 year lock-up periods forces LPs to realize suboptimal returns through distressed exits. Furthermore, opaque capitalization tables and manual shareholder administration result in high transaction costs and legal disputes.

Transforming equity stakes into blockchain tokens unlocks immediate liquidity through secondary markets, revolutionizing private investment. Smart contracts automate cap table management, eliminating errors and disputes while ensuring regulatory compliance.

Furthermore, fractional tokenization democratizes access, breaking down the 'accredited investor' barrier and allowing retail investors to participate in startup funding. Even traditionally cumbersome processes, like shareholder votes and equity transfers, become instantaneous through immutable on-chain records.

Commodities

The trade of physical commodities like oil, gold, and agricultural products continues to be hampered by outdated systems. Transactions can take weeks to finalize, numerous intermediaries inflate costs through unclear pricing, and the presence of counterfeit goods, such as fake gold, erodes trust in the market. This archaic structure disproportionately disadvantages small producers, who often receive unfairly low prices for their goods due to manipulated markets.

By merging the inherent value of tangible goods with the programmability of blockchain technology, commodities become tokens that can be traded 24/7 with built-in authenticity checks, effectively eliminating the need for intermediaries and their associated markups. This transformative model is gaining significant traction, evidenced by the increasing institutional adoption from established players like the London Metal Exchange.

Art and Collectibles

The art market is an old, exclusive club where masterpieces sit unseen for years in dealer networks. Moreover this closed ecosystem is full of barriers that effectively exclude all but the wealthiest individuals, while the artists who create these valuable pieces frequently see their work appreciate in value on the secondary market without receiving any further compensation. Even the supposed security of specialized storage facilities is not absolute, with numerous cases of collectibles being swapped or disappearing.

Blockchain fundamentally reshapes the art market by converting artworks into liquid, programmable assets. It enables fractional ownership of the collections thus breaking the entry barriers. Its immutable provenance records eliminate the possibility of forgery, and smart contracts guarantee artists receive automatic royalties on secondary sales.

Bond Market

The bond market, despite its size, suffers from surprising inefficiencies. Settling trades takes days, and high minimum investment amounts lock out most retail investors, leaving secondary trading largely in the hands of institutions. Governments and corporations incur billions in avoidable underwriting fees, while individual investors have to face issues like unclear pricing and complex paperwork for meagre returns. Even bonds considered "e;liquid"e; can become frozen during market turmoil, as the 2008 crisis starkly demonstrated when seemingly secure securities became impossible to value or trade.

Tokenization facilitates immediate settlement and continuous global trading of bonds, replacing days of cumbersome paperwork with the help of smart contracts that automatically manage everything from coupon payments to final redemptions, while also significantly reducing underwriting fees. By enabling fractional ownership, it breaks down the high investment minimums that previously excluded smaller investors, while the inherent transparency of the blockchain eliminates ambiguities in pricing and minimizes settlement risks.

How can your enterprise benefit from tokenization?

Liquidity

Tokenization is a game-changer for assets that aren't easily bought or sold. It converts them into digital tokens that can be traded on secondary markets without the usual friction. This unlocks fractional ownership, meaning that expensive assets like real estate and art become divisible into smaller, more affordable units for a wider range of investors.

Tokenized assets find a home on digital exchanges, where they trade non-stop. This always-on trading creates a level of liquidity that's just not possible in traditional markets. By making it easier and cheaper to invest, more people get involved, leading to a more active market and more accurate pricing. Exiting or entering an investment becomes much faster and simpler than dealing with conventional assets.

Cost Reduction

Tokenization is all about directness, eliminating the many hands that usually add cost and hassle to asset deals. A property sale that normally involves 5-7% in brokerage fees and thousands in closing costs can be executed on-chain for a fraction of the price

Plus, smart contracts automate all those ongoing administrative chores, from distributing profits to handling votes and ensuring compliance, which traditionally require large teams.

Accessibility

Tokenization is like opening a VIP club for everyone, giving regular investors access to premium assets they could only dream of before. Where private equity and hedge funds typically require six-figure minimum investments and accredited investor status, tokenized versions of these assets can be purchased in miniscule amounts.

This creates real chances to build wealth for millions who were traditionally excluded. I's especially powerful in emerging economies, where people can now invest globally without getting tangled up in complex international brokerage deals.

Real Time Settlement

The power of blockchain enables tokenized assets to achieve immediate or near-immediate transaction settlement. Through the smart contracts a "e;delivery versus payment"e; mechanism comes into play which ensures the simultaneous exchange of the token and its value, inherently mitigating the risk of settlement failure.

This efficiency is particularly advantageous for institutional investors, as it frees up capital that would otherwise be immobilized during extended settlement periods. This enhanced speed also unlocks opportunities for innovative financial products and sophisticated trading strategies that were not viable earlier.

Cross Border Transactions

Tokenization creates a truly worldwide investment landscape by breaking down geographic barriers. An investor in Asia can purchase tokens of US real estate with the same ease as local shares.

Blockchain's continuous operation means these markets are live 24/7 across all time zones. By eliminating cumbersome correspondent banking and cross-border settlement, international investing becomes far more affordable and straightforward.

Transparency

Tokenization boosts transparency by putting all asset transactions on a permanent, unchangeable blockchain record, accessible in real time to authorized eyes. This eliminates information asymmetry – every ownership change, trade, or company decision is tracked forever, preventing fraud in areas like real estate ownership or supply chain history. Thus, blockchain provides a single, trustworthy record for all stakeholders, without compromising private data.

Security

Security is strengthened through cryptographic ownership verification and decentralized custody. Investors hold assets via private keys rather than relying on intermediaries, reducing counterparty risk. Blockchain's tamper-proof design and smart contract automation prevent unauthorized transactions while maintaining compliance.

From Theory to Action: Making Tokenization Work for Your Business

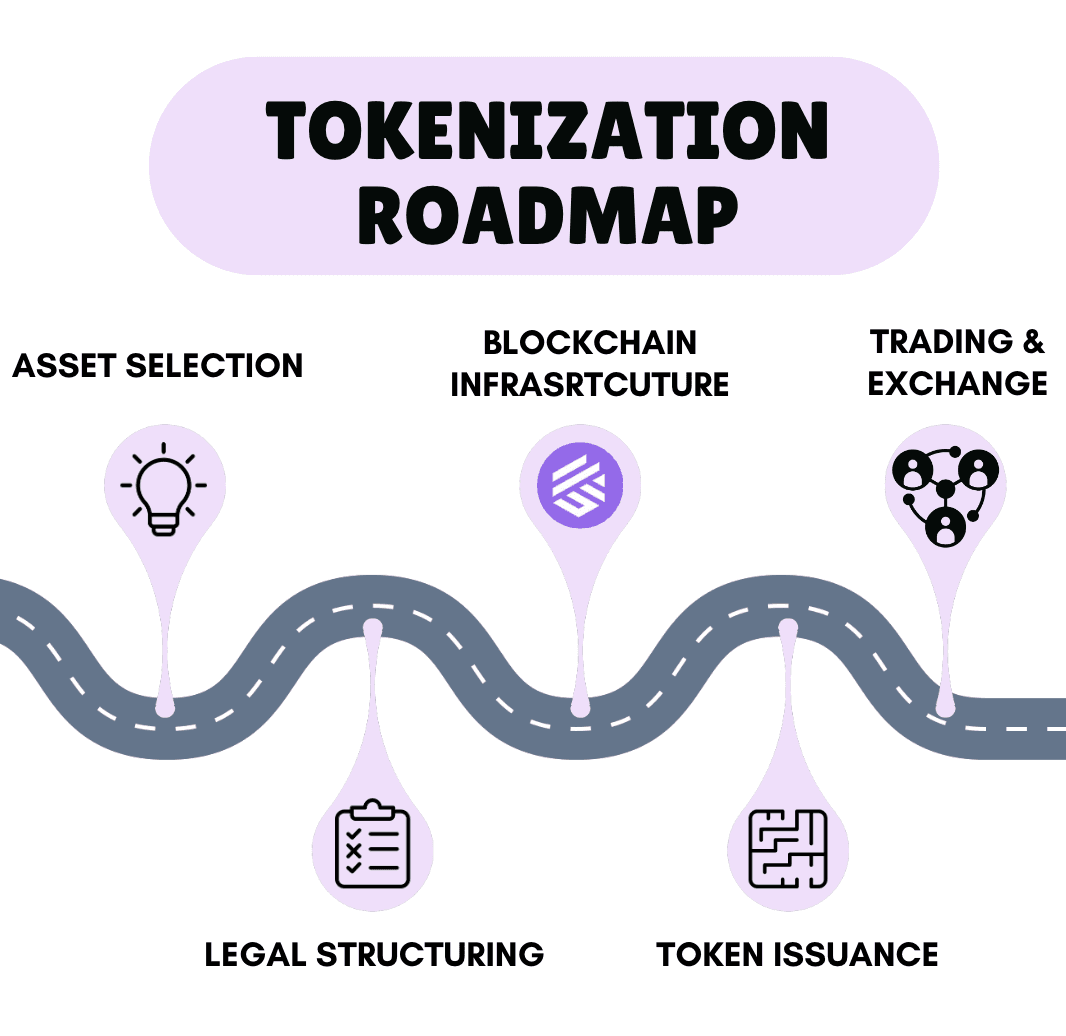

Tokenization offers tremendous potential for businesses – but how do you actually implement it to reap the rewards? Let’s discuss the stepwise approach for tokenizing your business’s assets.

1. Pinpoint High-Potential Assets for Digitization: Start by thinking about the bottlenecks in your business – which assets are sluggish, hard to divide fairly, or tangled up in complex ownership? These are prime candidates for tokenization.

Then, brainstorm: could you tap into new revenue by offering fractions of these assets? And where could digital tokens simplify your operations and make things more efficient?

2. Navigate the Regulatory Landscape: Getting the legal foundation right for your tokenized assets is non-negotiable. This means partnering with legal experts to structure your offering correctly and ensure you're meeting all the requirements for who can invest. The legal framework you set up will have a big impact on everything – from your marketing efforts to who is eligible to buy your tokens.

3. Implement Advanced Blockchain Infrastructure: Next we have to decide on whether to build a new blockchain for your tokenized assets or to use an existing one. The blockchains provide the brains of your tokenized assets: robust smart contracts. These are the self-executing digital agreements that will be the workhorses, handling everything from transferring ownership and distributing dividends to automatically checking compliance.

If you anticipate a lot of trading activity, you might want to explore zk-Rollups (zero-knowledge rollups) as a way to scale things up.This can drastically cut down on transaction costs and significantly boost speed without compromising the security of your underlying blockchain.

4. Execute the Token Generation:Once your legal and technical foundations are solid, you're ready to mint your digital tokens. This involves defining key details like the total number of tokens, whether they can be divided, and any release schedules for team tokens – all while adhering to your established legal structure.

5. Enable Secondary Market Trading: The final, vital step is to make sure your tokenized assets can actually be traded by listing them on the right platforms to ensure liquidity. Think about both established trading platforms that now handle digital assets and newer, blockchain-native decentralized exchanges (DEXs) like Uniswap and Sushiswap and Gateway’s native product-swap protocol.

Conclusion: Leading the way for tokenization

The shift towards tokenization isn’t just inevitable—it’s accelerating. As global markets demand greater liquidity, transparency, and accessibility, businesses that delay adopting asset tokenization risk being left behind. Traditional ownership models are becoming obsolete, and investors now expect fractional, borderless, and instant access to real-world value. Waiting isn’t an option—competitors are already moving, regulators are adapting, and capital is flowing toward tokenized ecosystems. The question isn’t whether to tokenize, but how quickly it can be done right.

However, navigating this transformation requires robust blockchain infrastructure and deep technical expertise—this is where gateway.fm steps in. As a trusted partner in blockchain-powered asset tokenization, we offer a seamless one-click solution to launch your customized blockchain. We allow you to choose from a range of ready-to-deploy blueprints, each tailored to different asset classes. Next, we ensure that you can leverage our comprehensive end-to-end tools for effortless management of your real-world asset platform.

The future of asset ownership is being rewritten, and with gateway.fm, your business won’t just adapt—it will lead.

Other blog posts

Want to read more? Discover our other articles below!