Hyperledger Is No Longer Fit for Banks

21 August 2025Hyperledger vs Web3: A General Overview

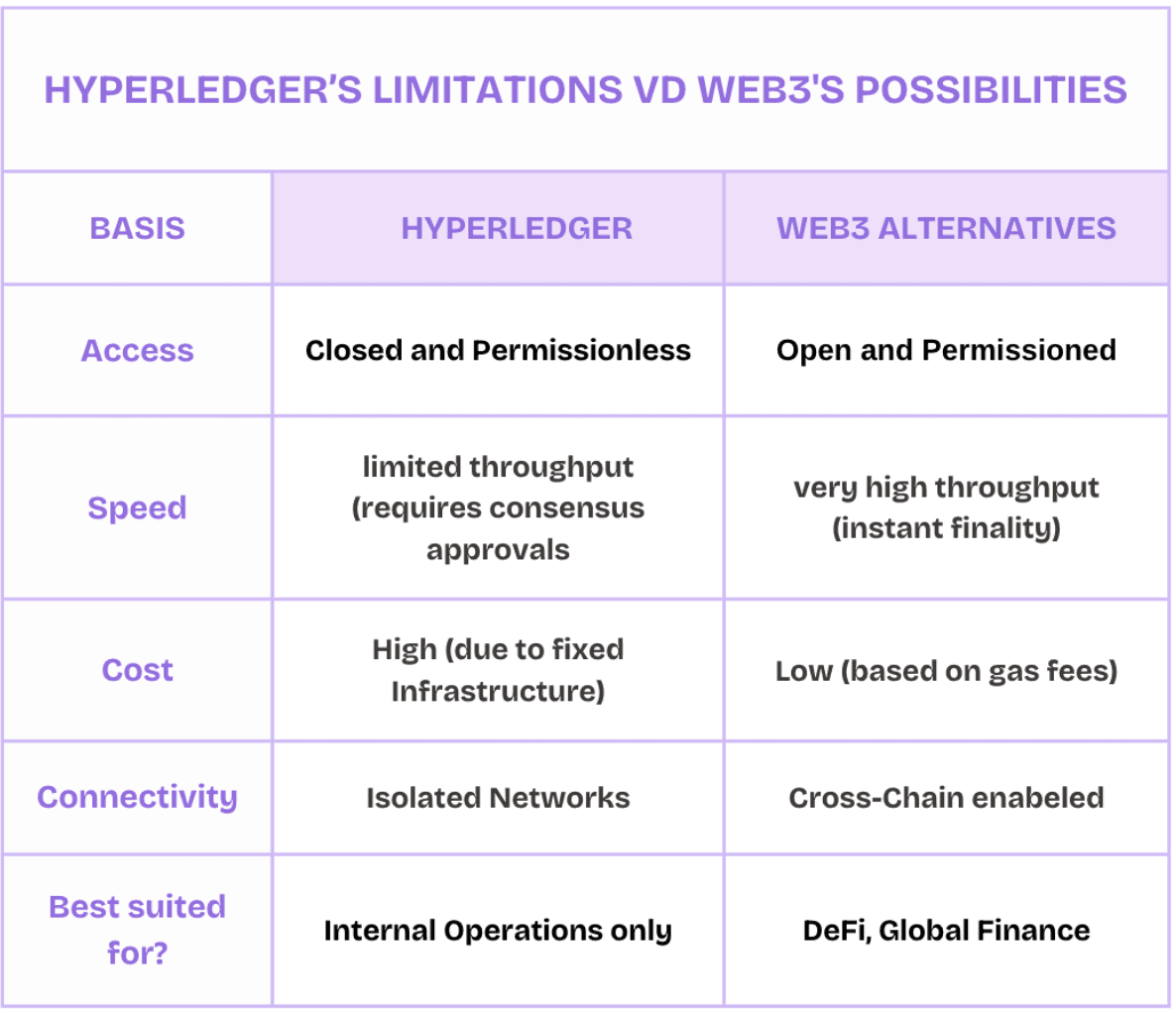

Before understanding the need for this much needed transition in Banking sphere, it is essential to clearly demonstrate how different hyperledger is from the WEB3 solutions.

Let’s imagine banking technology as transportation infrastructure. Consider a private corporate railway system, efficient for moving goods between company-owned facilities, but limited to predefined tracks and inaccessible to outsiders. The tracks don't connect to public roads or other rail networks, requiring expensive custom bridges whenever interaction with external systems is needed. Everything gets complicated as the quantity of goods being transported increases beyond a point.

On the other hand, Modern global transportation operates as a vast, interconnected network of highways, shipping lanes, and air routes - a seamless system where standardized containers move effortlessly between trucks, ships, and planes. International ports serve as bustling hubs for global trade, while intermodal terminals enable smooth transfers between different transport modes. This ecosystem thrives on universal standards that allow any compliant carrier to participate, offering the goods to flow across borders with minimal friction.

Like the private railway, Hyperledger offers banks a controlled, high-security environment for moving digital assets between approved participants. But this closed architecture creates the same limitations - the system can't natively connect with public blockchain "transport networks," forcing institutions to build expensive, fragile gateways for any external interactions. Just as the railway's private tracks prevent interoperability with public infrastructure, Hyperledger's permissioned design inherently isolates banks from the growing ecosystem of decentralized finance.

Web3 solutions resemble modern global transportation networks - a digital ecosystem where everyone can participate. Public blockchains form the digital equivalent of interstate highways, with smart contracts acting as standardized shipping containers that work across different carriers. DeFi protocols function like international ports where assets flow freely between networks, while cross-chain bridges serve as intermodal terminals transferring value between different transport systems.

How has Hyperledger fallen behind in banking technology?

Hyperledger's enterprise blockchain solution carries inherent limitations for modern financial applications. These key disadvantages reveal critical constraints banks face when implementing hyperledger technology:

1.Closed and Isolated Architecture

Hyperledger functions as an exclusive network, limiting participation to only pre-approved members. This inherent closed design fundamentally prevents direct integration with the broader public blockchains, DeFi platforms, and other cryptocurrency networks. Consequently, institutions, particularly banks, are compelled to develop intricate and costly bridging solutions to connect externally.

2. Slow Innovation

The permissioned nature of Hyperledger means all changes require agreement from consortium members. This centralized governance model significantly slows development compared to public blockchains where thousands of independent developers can propose and implement improvements rapidly, keeping pace with evolving market demands.

3. Limited Scalability

Hyperledger achieves its claimed performance by restricting network participants rather than through technical innovation. While this may show good numbers in controlled environments, it fails to provide the true, open-network scalability required for mass adoption and global financial applications.

4. Absence of Native Digital Asset Infrastructure

Hyperledger was not fundamentally built with native support for digital currencies or tokenized assets. This necessitates that financial institutions using the platform must often integrate complex, custom-built modules to properly handle and transact with these evolving modern financial instruments

5. Centralized Control

Despite being branded as blockchain technology, Hyperledger maintains centralized control through its permissioned validator model. A select group of institutions essentially operate the network, recreating the very centralized bottlenecks that blockchain technology was meant to eliminate in financial systems.

6. High Cost of Operation

Maintaining private Hyperledger infrastructure requires banks to bear all costs for nodes, security, and custom integrations. This proves significantly more expensive than leveraging the shared security and distributed costs of established public blockchain networks in the long term.

The Web3 Paradigm Shift in Banking Ecosystem

As discussed, traditional banking infrastructure deploying Hyperledger faces limitations in interoperability, scalability, and innovation. Web3 solutions such as public blockchains, smart contracts, tokenization, Layer 2 scaling, and ZK-proofs overcome these barriers, enabling seamless, secure, and efficient financial services.

Public Blockchains

Public chains like Ethereum solve Hyperledger's interoperability limitations through open participation and global accessibility. Unlike Hyperledger's closed networks requiring custom bridges, Ethereum connects seamlessly with DeFi applications and cross-border systems while eliminating centralized control points.

Tokenization Standards

Built-in token standards enable native digital assets that Hyperledger lacks. Banks can issue currencies and tokenize assets without complex workarounds. This would help them accessing public blockchain liquidity which is impossible in Hyperledger's systems.

Smart Contracts

Self-executing contracts automate financial processes without Hyperledger's bureaucratic delays. Permissionless deployment enables rapid innovation - loans, trade finance, and compliance tools can be created without consortium approval.

These smart contracts work in compliance with Oracles which provide tamper-proof real-world data (market prices, IoT feeds) to smart contracts, which on the basis of that information get executed. For example, banks can trigger payments based on verifiable events (flight delays, invoice approvals).

Cross-Chain protocols

Cross-chain protocols solve Hyperledger’s isolation by enabling seamless asset transfers between blockchains. Banks can bridge tokenized assets from private networks to public chains, accessing liquidity without the expensive custom integrations they have to avail while working with Hyperledger. For example, Card Integrator can act a bridge between block-chain based transaction and traditional payment systems.

Layer 2 Scaling

Solutions like Polygon provide real scalability with maximized throughput compared to Hyperledger's artificial limits. Banks gain enterprise-grade throughput while maintaining public blockchain connectivity at a very minimal cost as contained to Hyperledger.

ZK-Proof Compliance

ZK-technology offers auditable privacy superior to Hyperledger's all-or-nothing approach. Banks can verify compliance without exposing data, combining Hyperledger-grade confidentiality with public chain transparency that regulators prefer. As a result, private settlements become possible on open networks.

Customer-Centric Banking: The Web3 Advantage

Today’s banking customers demand faster, cheaper, and more transparent banking. Web3 ensures these features are delivered: by adopting blockchain-powered solutions, banks can offer instant settlements, lower fees, and innovative financial services that meet modern expectations while staying secure and compliant.

1. Instant, 24/7 Financial Transactions

Web3 technology enables transactions to settle in seconds, available around the clock without delays for weekends or holidays. Customers benefit from real-time cross-border payments and immediate access to funds whenever needed, eliminating the waiting periods typical of traditional banking.

2. Dramatically Lower Banking Fees

By removing intermediaries, Web3 solutions significantly reduce costs for international transfers and currency exchanges. Customers keep more of their money instead of paying excessive fees, making financial services more affordable and accessible.

3. True Financial Control and Ownership

Web3 empowers customers with secure digital wallets that provide full asset ownership while maintaining access to insured banking services. This balanced approach offers both independence and protection for users' funds.

4. Competitive Returns on Savings

Integrated decentralized finance products enable customers to earn higher yields on deposits compared to traditional near-zero interest accounts. Banks can now offer safe, attractive returns through regulated Web3 solutions.

5. Enhanced Security and Fraud Protection

Blockchain's transparency reduces fraud risks while advanced tools like social recovery wallets prevent lost access. Privacy-preserving technology keeps personal data secure during financial verifications.

Case Study: J.P. Morgan's Blockchain Dilemma - When Hyperledger Wasn't Enough

J.P. Morgan's blockchain experience shows the increasing limits of Hyperledger-based solutions for modern banking applications. The bank first created JPM Coin on its Onyx Digital Assets network (built on Hyperledger), which executed more than $300 billion in intraday repo transactions by 2023. However, the Onyx system could only provide service to a limited number of approved institutional clients, which was expected for a permissioned system, and it had no points of interconnection to financial ecosystems outside of the Hyperledger license.

These limitations prompted the development of the J.P. Morgan Deposit Token (JPMD) on public blockchain, indicating a strategic shift to more open infrastructure.The public blockchain implementation mitigates important limitations of the Hyperledger-based system by allowing for 24/7 cross border settlements with programmable compliance and DeFi (as possible within the public blockchain), which were impossible within the Onyx permission environment.

The Onyx permissioned environment allowed huge transaction volumes, but its architecture also effectively preclude participation in emerging tokenized asset marketplace and automated yield opportunities. The Deposit Token prototype shows that public blockchains can lower correspondent banking costs 60-70% while providing instant settlement - improvements, which drive the transformation from a favorable, but still closed, Onyx environment to the requirement for Web3 alternatives for next generation banking services.

To sum up, J.P. Morgan's dual blockchain strategy reflects banking's transitional phase—maintaining Hyperledger systems while adopting public chains to overcome their limitations. The Deposit Token demonstrates how public blockchains enable competitive digital asset services with compliance, highlighting Hyperledger's inability to meet demands for open connectivity and innovation in modern finance.

Conclusion: The Path Forward

The constraints of antiquated systems, such as Hyperledger, are impossible to deny in such a rapidly transforming financial environment. Web3 solutions—with their open architecture, smart contracts, and seamless interoperability—are no longer just an innovation but a necessity for banks aiming to remain competitive.

Blockchain-enabled banking provides critical solutions to significant issues, such as instant cross-border payments, regulatory compliance, and improved customer yields while opening up new possibilities. The transition is already underway, with leading institutions demonstrating Web3’s potential through real-world use cases like JPMorgan’s deposit token.

The evidence is undeniable: Web3 isn’t merely an upgrade, it’s the foundation for next-generation banking. Institutions that harness its potential will redefine financial services, while those delaying risk gradual obsoletion. The technology is proven, the market is ready, and the time for transition is now!

Other blog posts

Want to read more? Discover our other articles below!